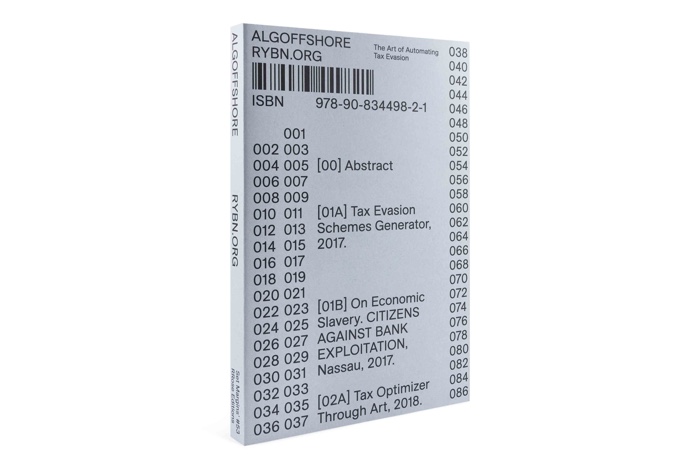

Quick review of a book that made me more knowledgeable and worldly-wise. ALGOFFSHORE. The Art of Automating Tax Evasion, by RYBN.org. Published by Set Margins’ and RRose Éditions.

With an article by Pekko Koskinen and interviews of Citizens Against Bank Exploitation, Le Freeport, Melle Smets, Lora Verheecke.

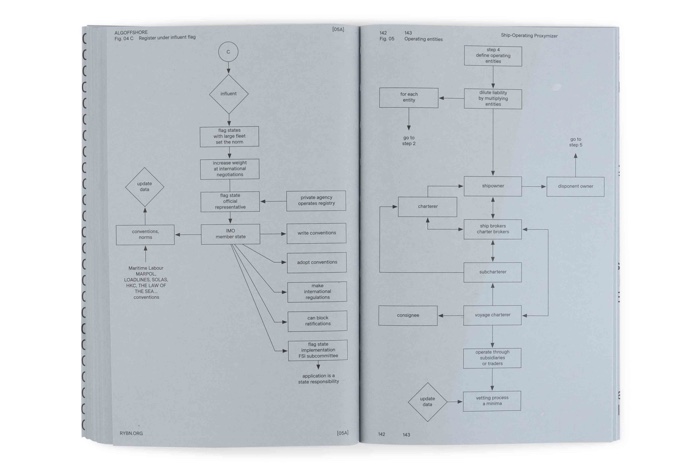

ALGOFFSHORE blends art, finance and geopolitics to build up a kind of “tactical manual for the art of evasion”. It’s didactic, straightforward and it might sometimes make your jaw drop. But more on that later. The book features five flowcharts that detail strategies for evading taxes or bypassing social and environmental obligations. These are the same methods of financial engineering that multinationals and enterprises deploy to optimise profits, render transactions opaque, ensure anonymity and sidestep any regulation that might get in the way of the accumulation of capital.

The five tax scheme flowcharts are based on rigorous study of patents, leaked documents, trial proceedings, reports and academic publications. RYBN also grounded their analysis on exchanges with experts and on field research in several EU countries, in the Cayman Islands, the Bahamas, Liechtenstein, Delaware, Switzerland, etc. While the systems presented in this publication only exist virtually, experts vetted them to ensure their operability.

Each flow chart is accompanied by an essay, an interview or the transcript of a tour in place that plays a significant role in tax evasion.

The first flowchart, TAX EVASION SCHEMES GENERATOR, brings to light the labyrinthine assemblage of proxies deployed by corporations to identify the most advantageous routes for tax optimisation. It is followed by an interview with members of the Bahamas-based civic organisation Citizens Against Bank Exploitation (CABE). The interview grounds tax evasion into neocolonial territory and fleshes out the impact of extreme financialisation on the local population. The members of CABE explain how their government keeps on serving interests of foreign -mostly Canadian banks- at the expense of the Bahamians, taxing the poor and the middle classes, failing to implement measures that would protect people against banks malpractices while cutting taxes on large businesses and banks. As for the existing cooperative banks, they are forced to remain small to favour Canadian ones, which shapes an environment in which foreign influences continue to dictate the way the Bahamas is ruled. Which doesn’t prevent CABE and other members of civil society to protest and ask for regulations of the banking sector.

Inside Luxembourg’s freeport. Photo: Gerry Huberty

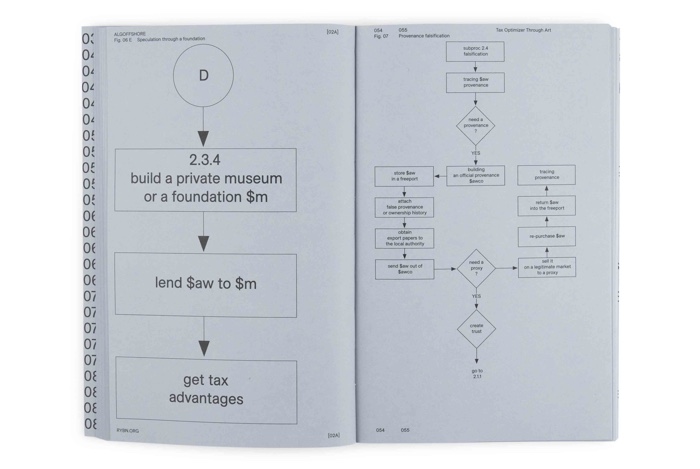

Flowchart number two, TAX OPTIMIZATION THROUGH ART, investigates how the art market and its dedicated infrastructures use artworks as financial vehicles. The flowchart is accompanied by a transcript of a 2019 visit to Luxembourg Freeport (now called Luxembourg High Security Hub) when the Freeport was conducting a PR campaign following reports exposing the role of Freeports in international money laundering, tax evasion and art trafficking.

Although the tour was meant to show its irreproachable facade and adherence to anti-money laundering legislation, there was nothing bland and boring in the transcript. It’s packed with truck control stations, threat identification mechanisms and Faraday cages. In the Freeport security arsenal are thermal cameras (used by penitentiaries and Israel) that can detect a heartbeat within a vehicle or a crate and biometric detectors that, instead of reading digital prints, capture the resonance of the venous system so “if someone cuts off a finger, they can’t usurp our identity.” The threats described by the guide are not always the ones you expect. For example, it seems that the Luxembourg Freeport sees terrorism as one of the most alarming dangers. Which is understandable until, they specify that they associate terrorism with people who protest concentrations of money.

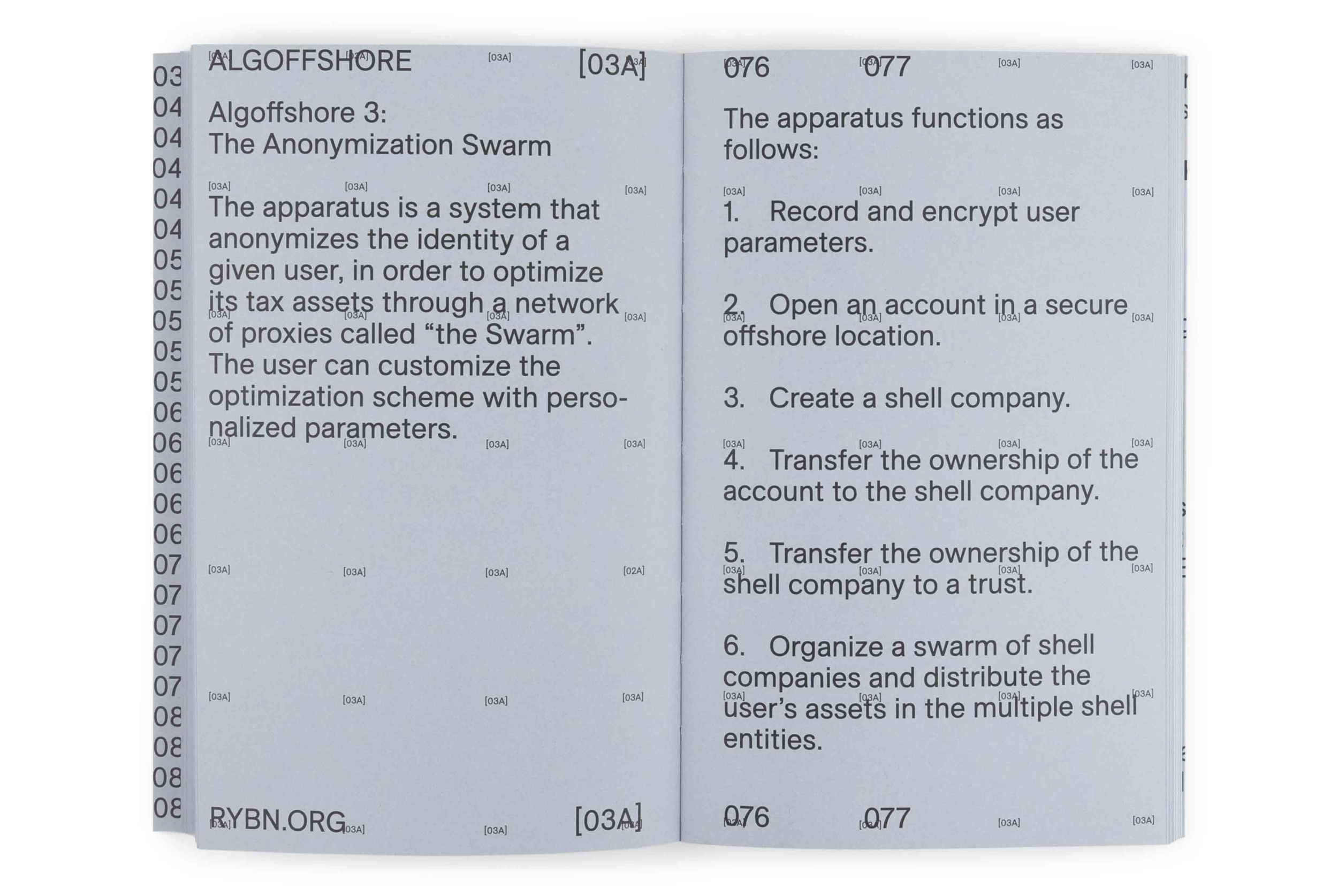

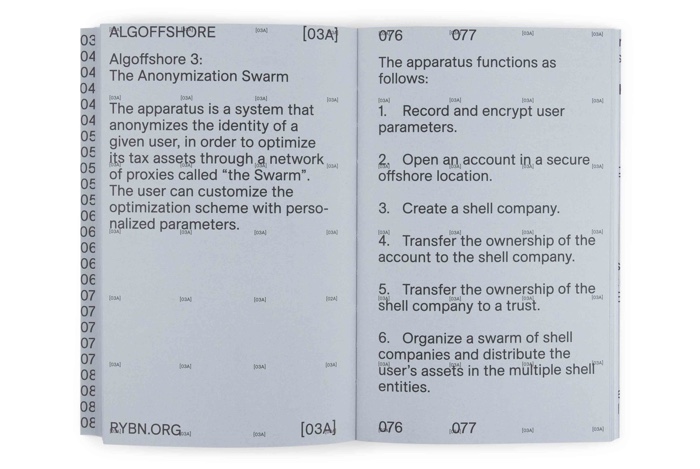

The third flowchart, THE ANONYMIZATION SWARM, explores the production of institutional anonymity through a succession of trusts. It is illustrated by the transcript of a “lobby tour” in Brussels’ European district led by Lora Verheecke from Multinationals Observatory Dark Side of EU tours.

And what a tour that was! The lobbying of European institutions is even worse than i thought. Much worse. Almost every paragraph in that text made me furious. For example, Verheecke reveals how one consultancy copies the techniques of NGOs and social movements to serve corporate interests. In a stunt created for a pharmaceutical company they worked for, the consultancy paid actors 10 euros per hour to pose as ill people and hold placards in front of the EU Parliament calling for the funding of medicine for rare disease. Further in the text, you read that for each European civil servant working on finance-related politics, there are three people working in lobbies. There goes my (already wobbly) faith in the fairness and transparency of EU institution. And it gets worse in the rest of the tour, but i’ll stop here. It’s painful enough.

Next, the CRYPTOLAUNDERING MACHINE examines money laundering via cryptocurrencies. With this fourth flowchart comes a text by artist Pekko Koskinene, member of the YKON and the Economic Space Agency (ECSA). He speculates on the impact cryptocurrencies have on the rules governing the global economy, from an emancipatory perspective more influenced by the rebellious spirit of A Game of War than by the technosolutionist vision of libertarian extropianism.

Finally, SHIP-OPERATING PROXYMIZER, produced after the explosion of the ammonium nitrate shipped to the port of Beirut on a Moldovan-flagged cargo vessel, details the array of strategies used in marine transport to circumvent regulation, especially the flags of convenience. The flowchart is accompanied by the transcript of a psychogeographical visit of Port of Rotterdam organised by artist Melle Smets in 2019. The tour looked at the transnational network that divides the territory in many grey areas. The port of Rotterdam features a completely automated Chinese concession, a parking garage for ships, oil refineries, an obsolete container terminal, an iron ore bulk storage facility, a depot for the sand dredged from the harbours, a factory where Nike are assembled, etc. On top of which are historical layers, problems such as a harbour that doesn’t grow as fast as the jumbo container ships and a fauna merrily visiting automated areas that make the presence of humans superfluous.