In my naive and poorly informed mind, the stock market breathes at the rhythm of men wearing dark suits, pressing an earpiece against their head and frantically raising and waving their other hand. Mine is however a very antiquated vision of trading. Investing and speculating, it seems, is now mostly controlled by algorithms. These computer programs speculate, send and cancel orders tirelessly, basically doing the job of a human trader. Just much, much faster. So fast that they can execute a trade in milliseconds and even microseconds. That’s why we are now talking about high frequency trading algorithms.

The volume of trade goes far beyond human physical perceptions. These bots are so fast, they can flood the market with millions of fake information to confuse and hide their true investments. The process is called quote stuffing.

Photo by Benjamin Gaulon

Photo by Benjamin Gaulon

RYBN have been investigating the world of finance since 2006. Four years ago, they even launched their own trading bot on the financial markets. The autonomous program executes, buys and sells orders online, and its activity is mapped into real-time visualizations such as charts, soundscapes, and timelines. Its Twitter account even provides details about ongoing orders. Its performance will end when the bot reaches bankruptcy.

More interestingly, RYBN’s program is distributed in open-source format. Unlike the black box of the algorithmic and high-frequency trading.

Members of RYBN were participating to refrag, a series of workshops, talks and performances that took place in Paris a few weeks ago and that explored Glitch Art. Their presentation looked at what happens when HFT algorithms slip, glitch and disrupt the trading system. Basing their research on a rigorous analysis of documents available online, the artists analyzed four famous ‘flash crashes.’ They mostly used the data compiled by Nanex, a firm that offers streaming data on all market transactions and distributes the data in real-time to clients.

The automated trade execution systems i mentioned in the opening paragraph might be sophisticated but they are far from flawless. Once in a while they act in unforeseen ways and trigger “flash crashes”. A flash crash is a sharp drop in security prices occurring within an extremely short time period. And because algorithmic trading is disconnected from the economy, any variation is an opportunity for a flash crash.

Image via Nature

Image via Nature

The most famous flash crash is called… ‘the Flash Crash.’ It occurred on 6 May 2010, when the Dow Jones index dropped 9% in minutes. The loss was estimated at one trillion dollars. The US stock market then took a few more minutes to right itself back. During that short period of time, some trades were executed at extreme prices (either very low or very high) After the event, it was agreed that all transactions made that day between 2:40 and 3 p.m. would be canceled. No one knows exactly how the crash happened but many attributed it to some miscalculation of HFT algorithms.

RYBN made a sound work out of it. Flash Krach turns into sound the raw data of the day, recorded from the 9 stock exchanges routed on the NYSE.

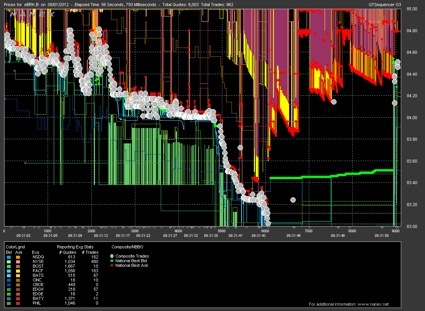

One of the Nanex Tick Charts of Knightmare event

One of the Nanex Tick Charts of Knightmare event

Another important flash crash took place Aug. 1, 2012. Knight Capital, one of the biggest executors of stock trades in the United States, suffered a technical glitch in its algorithmic trading systems, causing stocks to be misquoted (the algorithm was apparently buying high and selling low which doesn’t sound like a very lucrative formula) and costing the firm more than $440 million in 40 minutes.

An analysis by Nanex explains that almost all these trades alternate between buying at the offer and selling at the bid, which means losing the difference in price. In the case of EXC, that means losing about 15 cents on every pair of trades. Do that 40 times a second, 2400 times a minute, and you now have a system that’s very efficient at burning money.

The computer-trading glitch was nicknamed, the Knightmare.

Screenshot of the fake AP tweet

Screenshot of the fake AP tweet

Another memorable flash crash occurred when the Twitter feed of the Associated Press was hacked and a false tweet announced that the White House had been hit by two explosions and that Barack Obama was injured. The Dow Jones dropped about 150 points in a seconds before bouncing back when traders realized that the tweet was a hoax.

The event revealed how high-frequency trading algorithms comb Twitter and other news sources, interpret them and almost instantly turn certain words into trades. It also shows how vulnerable the markets are to random pieces of information.

RYBN also noted that algorithm trading is calibrated to work in ‘normal’ conditions. The system will work seamlessly until it meets a black swan such as this fake tweet. The black swan broke the system and the trading strategy had to be re-calibrated accordingly.

The last flash crash is the humiliating one that BATS (Better Alternative Trading System) suffered in March 2012. The company had to withdraw its IPO when, in mere seconds, its shares plunged to less than a penny from the $15 IPO opening price.

The trades were later voided.

Some believe that the crash was due to a software glitch but others think that it was the result of a malicious, 100% intentional Nasdaq algorithm that purposefully brought BATS stock to a price of 0.00 within 900 millisecond of the company’s break for trading.

What is sure that, as is often the case, the precise cause(s) of the flash crash remains unclear. The markets remain thus at the mercy of technological outages that cannot be predicted or even fully understood.

RYBN’s concluding words were that these four crashes received much attention from the press but in fact, flash crashes, and the permanent state of instability they create, are now part and parcel of the way the market works. Nanex estimates that 18.000 mini flash crashs or Flash equity failures were reported between 2006 and 2011.

I think i’m going to read Flash Boys: A Wall Street Revolt, Michael Lewis‘ book about the role of high-frequency traders in global stock markets.

See also this other presentation i heard at refrag in Paris: The 3D Additivist Manifesto + Cookbook.