Image credit: Theo Games Petrohilos

Image credit: Theo Games Petrohilos

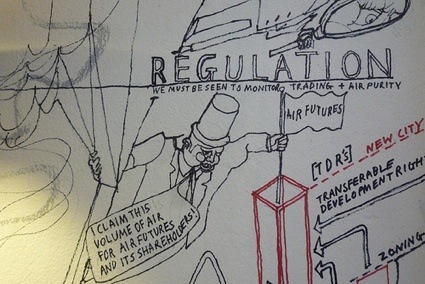

If there’s one student show that never disappoints, it’s the Bartlett Summer Show. There are models over drawings over installations over plans over rendering. Over the floor, the walls and the ceilings. Year after year, that show is consistently eye-pleasing and inspiring. The exhibition is now closed but i caught up with one of the new graduates, Theodore Games Petrohilos to talk about Air Futures. The speculative project investigates the trade of Air Rights (TDRs – Transferable development Rights) which, in real estate, refer to the empty space above a property. Generally speaking, owning or renting land or a building gives one the right to use and develop the air rights.

What would happen if the regulation of air rights was given free rein, if air became a commodity that could be bought and sold? How would the trade physically manifest itself? Can we imagine that one day an Air Bank will open in the heart of Manhattan?

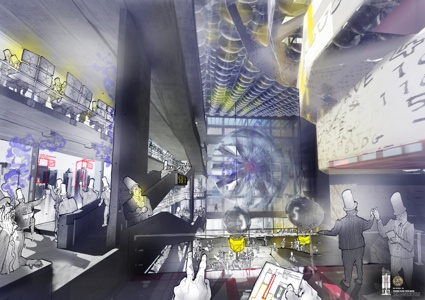

The Wall Street headquarters of the Air Futures Company – the company controls the trade of Air Rights in New York. Image credit Theo Games Petrohilos

The Wall Street headquarters of the Air Futures Company – the company controls the trade of Air Rights in New York. Image credit Theo Games Petrohilos

The Air Futures project speculates on the apparition and spread of a system that would manipulate, buy and sell air. The work explores both the legality and physicality of the air above New York.

Here’s the result of the Q&A session with the architect:

Hi Theo! Air Futures is a speculative project but it is anchored in elements of reality as well.

Could you explain us what they are?

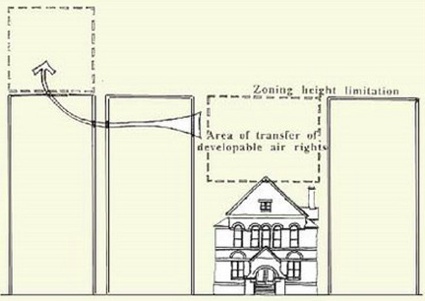

Yes, the fact that this project emerged from existing realities is what made it so exciting to work on. Air Futures is the speculative evolution of the air rights trade in New York, where volumes of ‘air’ are bought and sold to facilitate complex development manoeuvres over the city’s grid. The trade in TDR’s (Transferable Development Rights) works on the basis that the owners of a plot in the city should be able to fully exploit that plot, as an extruded volume up until the full height of the city’s zoning limits. So if the existing building on that New York plot doesn’t reach the full height of this invisible zoning limit, then the owner of the plot can sell the leftovers! This is what my project deals in – the leftover developable volumes of space above the city’s urban landscape, and the further ramifications, and processes that arise from giving this air value.

View of the model and drawings at the Bartlett Show. Image credit Theo Games Petrohilos

View of the model and drawings at the Bartlett Show. Image credit Theo Games Petrohilos

How and why would the trading of air appear?

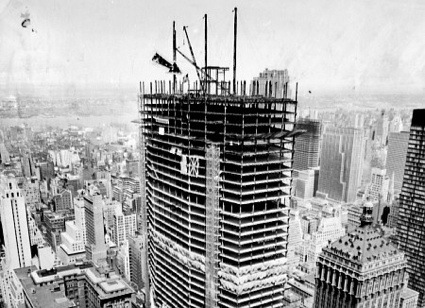

At the moment, the air rights trade allows the transfer of these developable volumes under strict rules. For example, you sell the space above your building, and the new owner can build his new building over your plot or bend over it. This happened in 1962 with the Pan Am (now Metlife) Building, the first foray into air rights, where the largest office building at the time was constructed over the historic Grand Central Terminal. The air rights volume can also be transferred to another area, across the road or over strict movements in the grid, to develop elsewhere, and to allow development beyond the set zoning limit. This action of maximising a plot’s value without destroying the existing structure has proven to be a valuable tool for the ever-densified city: selling air rights to gain the full ‘value’ of a plot without physically touching the existing building itself.

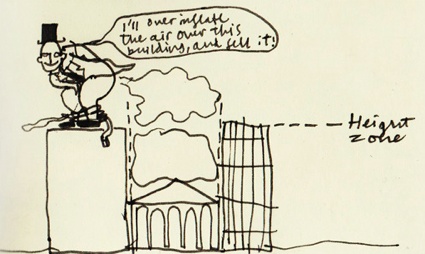

The value of these air volumes have the potential to be enormous, for example, in 2005 Christ Church on Park Ave and 60th sold its air rights to developers building on the same block for $30 million. The value of that air volume was based on a speculative idea of what could be developed with it. What fascinated me, was that people where, and are paying millions of dollars for ‘air’, that is ‘air’ as a legal entity – a potential future developable volume that could reap even more gains if moved elsewhere, and perhaps joined with other volumes of air. Whole skyscrapers can be built from air rights accumulated from the same block, but now there is real talk of the expansion of the system – air is going public.

Images credit: Theo Games Petrohilos

Images credit: Theo Games Petrohilos

Government officials and speculators alike are looking into the creation of an ‘air bank’, where air rights can be accumulated and divided just like shares. Air rights will also be able to be transferred from one district to another, so the playing field will be larger, as will the potential profits. Brokers and traders will be brought in to facilitate these movements for new investors, who are betting on the potential of these air stocks to perform for them. The New York air rights trade is currently to do with relatively micro- transactions, with values closely associated with both the donor and receiving sites – as a development tool it appears to be manageable. As an investment tool, air becomes subject to the same systems that got us into our current financial mess, it becomes totally detached from reality and fully enters the maniacal world of speculation. We now see air as a commodity and this is where the Air Futures Company comes in.

The Pan Am Building (image)

The Pan Am Building (image)

What ‘air’ are we talking about? It’s not simply oxygen, right?

Well the term ‘air’ defines a legal volume with invisible boundaries, it’s a completely intangible commodity, its values are based on speculative futures. As the air trade becomes more detached from the actualities of the development of a city and sways more to the fluctuations of a financial market – for the system to pertain to be sustainable it must try and find a solidity of value. In my thesis for this project; ‘The Architecture of Mania’ I explored how constructions around other intangible commodities create this tangible notion of value – these, like the Air Futures trade, I define as ‘manias’ that are subject to the crazed emotions of crowds and instinctual reactions to environments. In my research, I saw how important it is to give architectural physicality to these ‘commodities’ in order to excite a value in the mania as a whole.

Starting from Marx’s assertions about commodity fetishism (that eventually led to revolutions!) arising from a detachment from physical production, I needed to define the physicality of this air being traded – give it a more solid value and gain the trust of investors already sick of intangible sub prime mortgages etc.

For example, the ascetic practice of St Simeon Stylites sitting on his pillar in 4th Century Syria for nearly 40 years, without being called a madman showed the power of his architecture. By giving physicality to his desired state “betwixt heaven and earth” with his pillar, his inaction gained a value – it separated him from the everyday earth below, and people could physically relate to his beliefs.

This is the same need as the Air Futures system, they need to separate their commodity from the everyday air of New York to be shown to asserting some sort of control over it. As the air above New York becomes bought, and traded through the Air Futures Company they erect red boxes to define their ownership of those volumes and presence in the city. These frames act as signifiers to excite potential investors in the city and define the intangible air. The Air Futures headquarters on Wall Street confronts investors with controlled flows/gusts that create certain boundaries and thresholds in the building. These ritual paths and thresholds come from my research into the grand museums of art like the Altes Museum, and Louvre etc – places that have to create value in ART: another commodity with intangible values.

Image credit: Theo Games Petrohilos

Image credit: Theo Games Petrohilos

How does the project reflect current commercial practices?

How does the project reflect current commercial practices?

The use of manipulated oxygen levels around the building are used to excite traders and investors alike into euphoric states. I used these to highlight the addictive and unstable nature of high-risk investing and aggressive speculation we see today. I tried to reflect that in the crazed eyes of the fat cats that inhabit my spaces and illustrations for the project.

With the Air Futures system I aimed to create a scenario that evolved what I see as the mania of speculation. The project is very much based on existing practices, albeit with a critical eye. I tried to reflect little reasonable ventures that accumulated to make a quite unsettling proposition. Its like the traders of todays financial markets saying “its okay to take this little risk”, without thinking of the ultimate impact on the rest of the world, and everything, all the livelihoods staked against their little actions.

Detail of the model. Image credit: Theo Games Petrohilos

Detail of the model. Image credit: Theo Games Petrohilos

Could you walk us through how the trading would take place? Who buys the air? How is it distributed?

The whole Air Futures building is arranged into hierarchies that reflect the attitudes of the system. The Air Futures Building raises itself above the street on a new city datum, which serves to separate the traded and valued air, from the everyday air of the city. The concrete ritual paths into the building, serve to create a feeling of entering another realm, where this valued air resides, and is controlled by the commercial system. Investors are then led up through the regulator spaces of the system, who check both the legality of trades and monitor the purity of claimed air – the system has to be seen to be under control after all. There are then the Air Club sections of the building, where people come to literally get high on air – the commodity – and then trade on the city set out below them. Then there is the Trading Floor, where crowds of euphoric Air Futures traders shout and hustle to inflate stock values, in a sort of gladiatorial performance. They watch trading fluctuations on ionised air barometers on the ceiling that glow with each change in the market. The systems played out in the building are intentionally dense, to echo the alchemic nature of their speculations. The traders are after all turning air into gold.

The trade floor. Image credit: Theo Games Petrohilos

The trade floor. Image credit: Theo Games Petrohilos

Could this kind of trade spread to London and other European cities?

Of course! With cities around the world getting more intense, with populations growing in space hungry metropolises, people are always looking upward. I treated air in this project as the last commodity to go public, and it has the ability to reap infinite revenues. In London for instance, cash strapped local governments or historic buildings would be able to sell of their air rights to sell to designated ‘high zones’ in the city or other cities in the EU for that matter, pretty much like a carbon credit system, but for development. Its all ridiculous of course but possible. I’ve tried to play the devil’s advocate with this project and say “what if it goes this far?”

View of the model and drawings at the Bartlett show

View of the model and drawings at the Bartlett show

How would ‘normal’ people be affected by this trade?

On the physical side of things, if all the air in a city becomes privately owned and that ownership is asserted, it’s possible that new types of responsibilities could arise. These could be to do with possible threats to that air above the city and its purity. These subjects were tackled for instance in New York’s Times Square after September 11th, where studies were undertaken to assess the possibility of building owners fortifying the public realm from possible terrorist attacks on the air breathed.

The city would see development take place above the standard city datum. This traded air, with highly inflated values would end up inaccessible to the general public, they would end up priced out of the market, and a new ‘oppulent datum’ would arise.

If people tie up their livelihoods with this new market that promises so much, pensions, jobs become linked to the price of air – the last commodity, and we end up in the same situation as 2008. I have tried to say that we don’t learn from our mistakes, and the alchemists who create financial markets are always in work, able to re-invent the same excitement again and again. After all what is money anyway? Just IOU’s made out of paper.

The Air Futures story is pretty dystopic, but of course it’s speculation.

Thanks Theo!

All images courtesy Theo Games Petrohilos.

Related story: Airspace Activism.