The Arktika rear view

The Arktika rear view

On Monday i went all the way to the Royal College of Art’s new Battersea buildings to check out the graduation show of Design Interactions. As i’m sure you know by now, the department is exploring design in relationship to the latest technology and scientific developments. This year, however, several projects are dealing with what they call ‘big design’. Big design gets to grip with complex systems and large contexts such as global finance and geopolitics. If you remember how much i liked one of the projects from last year, Everything Ends in Chaos by Ilona Gaynor, you’ll understand how excited i am to see how ambitious political and socio-economic themes can be approached from a critical design perspective.

Which brings me to this year’s ‘project from hell’. It’s one of my favourite works but it took me ages to half grasp its ramifications and elaborate structure. Tobias Revell has spent the year drawing up a timeline that starts at the end of the Roman Empire and closes in the early 22nd century. The timeline unravels the history of power in whatever form it takes. Most historical timelines will only highlight the financial crashes, the wars, the major upheavals, the groundbreaking innovations and the revolutions but Revell also takes into account the minor events that might take decades to manifest themselves into something more noticeable.

One of the works Revell is showing at the graduation show illustrates the timeline by zooming on one event of our not-so-distant future. The event is seen at the time as fairly insignificant but it will have huge consequence on the history of the European Union. In fact, it will be one of the motors of its dissolution.

The event takes place in the early 2040s, when an ex-Soviet Arktika class, one of the nuclear powered icebreakers traditionally used for clearing shipping lanes north of Siberia as well as for scientific and recreational expeditions to the Arctic, is recommissioned to host a barely legal experiment in global finance.

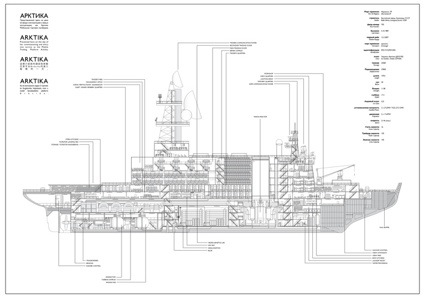

One of the original icebreakers Arktika class ship

One of the original icebreakers Arktika class ship

The icebreaker would be entirely refitted to welcome highly qualified traders on board and would circle at 88.7 degrees latitude – the heart of the arctic sea. By circumnavigating the world in twenty-four hours, the ship would thus stay in constant contact with trading zones throughout the world.

Such practice would undoubtedly be highly efficient and in Revell’s scenario it is indeed a phenomenal success. The Arktika proved that growth in trade could be sustained beyond state regulation with lower risk due to its detachment from public and welfare infrastructure. In doing so it had brought support to the idea of a hyper-libertarian Europe.

The sheer volume of trade made possible by the continuous, rapid and deregulated system of the Arktika’s movements and its elite traders invalidated economic theories of zero-sum growth in the eyes of the Equestrian Councils and business leaders – encouraging decades of power shifts throughout the financially developed world.

In September 2048, after almost a decade of transitional process, the European Equestrian Council was granted the control over European Parliamentary directives and began the process of turning Europe into a successful transnational business entity and away from historic national divisions. The Arktika was seen as a key component in this process. By 2055 – when China collapsed – there were no sovereign currencies or indeed Euros left in the European Equestrian Union.

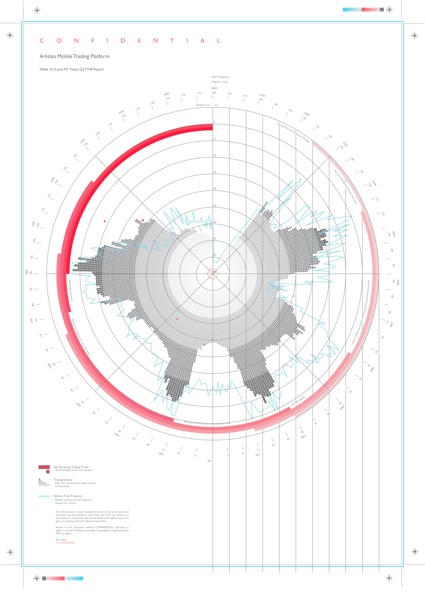

Chart showing the movements and trading patterns of the Arktika over a one-week period

Chart showing the movements and trading patterns of the Arktika over a one-week period

At this stage, dear reader, i suspect that you’ve either left the building in horror at the third paragraph or have at least as many questions as i have for Tobias:

Hi Tobias! Your project 88.7 is set in the early 2040, just before the European Union and its nation-states are dissolved and become a uniform ‘European Equestrian Union”. Could you briefly sum up how the Equestrian Council comes into existence?

The original Equestrian Councils were a short-lived institution of the Roman republic – a council of business leaders with the right to influence and even veto government policy if it was felt it might damage merchant interests. In the not-too-distant future, Europe faces a continued dialectic struggle between the nature of high-finance and national economies so in 2025 Italy re-establishes its own Equestrian Council. Italy and notably Austria have uniquely insular economies, they’re pretty self-sustainable but also economically jealous so I see them as a potential flashpoint for future economic progression.

The idea of the Equestrian Council begins the end of nation-states as global actors. I was inspired by something I read around 2008 about how states are the worst bodies to be put in charge of economies because they only know how to spend money, not make it and so there’s no way to sustain growth if something that is expert in gathering rolling debt is in charge of regulating the flow of money. Not that I fully buy into that.

Timeline that charts the change in flow and concentration of power since the end of the Roman Empire

Timeline that charts the change in flow and concentration of power since the end of the Roman Empire

What i’d need more explanation about is how the right to trade has changed? You told me that right now, one has to be registered in a particular nation and only trade within that nation, right? So how has the scenario changed at the time of 88.7? Why is it allowed to trade ‘transnationally’? And to do so in the Arctic?

I don’t see it as a big change. It would be something infinitesimal, slipped under the mat at late-night sessions of senates and parliaments in a process that takes place over years. There are very few huge events that are themselves ‘turning points’ in history, more often they come after the fact. For example, the fall of the Berlin Wall was endemic of the crumbling power structure in the USSR, not the other way round. This legal shift was again inspired by real life events such as the relatively silent repeal of the Glass-Steagall Act in 1999 that led to an explosion of complex high-risk instruments and the 2008 crisis.

So I see it as a loophole, it would be something that maybe no-one would explicitly legalise or even consider. There was a great defence from Her Majesty’s Revenue and Customs when the whole Vodafone tax-avoidance thing surfaced. HMRC pointed out that Vodafone had hundreds of world-class high paid tax-law experts on their team while HMRC was headed by a couple of guys with classics degrees from Oxford. So, it’s a thin screen. In legal terms, between now and then, and no-one will notice when it’s broken through until long after it has happened.

How has the boat been retrofitted? With special technology for trading or just with space, comfort and entertainment for traders?

How has the boat been retrofitted? With special technology for trading or just with space, comfort and entertainment for traders?

Actually, that’s one of the most thorough things and one of the least noticeable. I rigorously re-designed the ship based on real plans of the original Arktika fleet. Of course, it has a trading floor and server space, which is very high-tech since the entire operation is about brevity and intensity of trade, but the traders don’t live in comfort. To me, this is an industrial operation.

In social terms I can see traders and bankers as our new livestock (and populist scapegoats.) But again, the ‘greed’ and brutality of high finance is not symptomatic of itself. It’s like that because in the seventies and eighties, we – or our parents – wanted credit, growth, houses, holidays and cars we couldn’t afford without paying the labour cost. So, the traders are a resource for this growth, just like an oil well or a herd of cattle and the ship treats them like that, they have little space, are intensely ‘milked’ for their risk-taking abilities and then are shipped off – back to pasture in the real world until they’re called in again. They might not sleep for weeks and they willingly subject their bodies and minds to colossal amounts of strain because they get a hit from the trade in neuro-biological terms and the boat makes money.

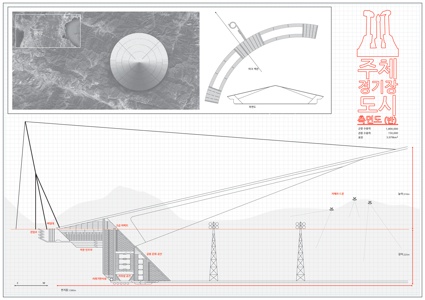

Juche City Stadium in North Korea is over 2km in diameter and able to home up to over 1.8 million Arirang mass-games performers

Juche City Stadium in North Korea is over 2km in diameter and able to home up to over 1.8 million Arirang mass-games performers

Now North Korea remains under the same regime, right? Except this time it is with the benediction of the UNESCO that calls it a World Intangible Heritage. Why would the traders on the Arktika be such fans of the Arirang Mass Games, the yearly festival of giga-choreography dedicated to the regime?

It’s an ideological clash. I suppose this is quite a personal part – I’m fascinated by ‘alternate’ regimes, especially socialist autocracies but I am especially deeply obsessed by North Korea. In ‘western’ or developed social economies we suffer from a resource shortage in attention. There are so many disparate demands on our attention – attention that represents both purchasing and labour power that we’re nearly at a ceiling beyond which there is no more economic acting an individual can physically perform in their lives. Of course, making processes faster such as transactions and digitising product is helping but ultimately there are just too many things to do and look at. North Korea is the total opposite, in a way it’s much like the Roman Empire in social economic terms, in that it is everything. A resident of North Korea only has one body to answer to, work for and gain from and that is the state.

So, in a world where states are beginning to or have already dissolved, where individual competitiveness is encouraged and we answer to less and less socially higher powers I imagine the idea of seeing two million perfectly choreographed performers in devotion (staged or genuine) to a common cause to be hypnotising – much like a flotilla of boats on the Thames, military parades, even ballets.

The traders on the Arktika are the peak of the hyper-libertarian Equestrian ideology while North Korea represents its opposite – the national project, the common homogeny, social harmony, etc. Even if it is forced at gunpoint. In the scenario investment from Japanese and South Korean media companies build the stadium and broadcast the games, much as is already happening in their exclusive economic zones and the Egyptian hotel construction work.

In which currency are they trading?

They’re on the cusp of the changeover of currency. Currency is just a measure of trust or creditability, so it could be anything. The dissolution of states begins the collapse of the idea of sovereign currency – trust in nations – and it turns to the alternative global construct that guarantees growth overall which could be futures. So they use futures contracts which are derivatives of potential ‘things that might happen’ as a currency – if you want to call it that.

Extra-Dermanl growths caused by neuro-biological mutation in Arktika traders

Extra-Dermanl growths caused by neuro-biological mutation in Arktika traders

Your text mentions the intensity of risk undertaken by traders on board. Which risks are they taking that today’s traders are not taking?

The same risks are faster, greater in value and more intense. Just like growing industrialisation – same product but more, faster, better. Technology can ramp up trade to the speed of light but it can’t take risks. Trade needs the human factor – the intuition and guile that involves making trades. Computers can calculate perfectly but that, in fact, makes machines poor traders. The traders on the Arktika deal with a greater torrent of activity enabled by activity, they take more risks, with greater consequences more regularly. This the only way to guarantee growth, the one thing every human economy is obsessed with.

Finally, i’m very curious about the way you chose to present the work, using texts that detail the life and feelings of various characters involved at various levels in this transnational trading. Why did you chose to present the project through their voices? Did you write the texts yourself?

Finally, i’m very curious about the way you chose to present the work, using texts that detail the life and feelings of various characters involved at various levels in this transnational trading. Why did you chose to present the project through their voices? Did you write the texts yourself?

I wrote everything myself, I’m very comfortable with writing and all the stories as well as more intensive expositions on the economic theories were all written in parallel with the research and development of the project over the last year or more.

It’s very hard to present huge, complex systems. In the mind or in the pub over a few drinks they can be beautiful and elegant as well as easy to explain, but communicating that without just standing and talking is very hard. I was talking with Ilona Gaynor, a graduate from last year who had a similar problem with presenting and a similar admiration of systems and we agreed that anyone who understood the financial crisis of 2008 would never criticise it because it was so elegant. But how can anyone present that understanding quickly and simply without talking it through step-by-step? Presenting such an intuitive understanding of the levels and dimensions of these events, their precursors and their systems is very hard.

I think by starting at the individual level, you can begin to draw strands from how one person sees and acts in this system and begin to thread it through the other artefacts, perhaps encouraging understanding of their place in them. When we talk about things like economics and finance we tend to nod to systems and constructs and then scapegoat individuals or point the finger. But the system and the individuals are not mutually exclusive.

Aesthetically, the stories lend the project a literary edge which makes it feel more real to me. When a character is talking about the way steam curls off above the ice from vents on the ship it’s more real to me than any rendering and I think a much more powerful way of engaging with these huge ideas than often charts and diagrams can be.

Thanks Tobias!

The RCA show opens today at the Battersea location (see map) and remains open until 1 July (closed 29 June.)